Economic and Financial Interlinkages

Climate change is a long run, intergenerational crisis, and one that can only be averted through significant short-to-medium term technological and behavioural change. Modelling from the IPCC shows that in order to avoid catastrophic impacts to communities and ecosystems post-2050 we will need to move to “net-zero” emissions (i.e. achieving an overall balance between greenhouse gas emissions produced and greenhouse gas emissions taken out of the atmosphere).

Such targets embody a rapid decarbonisation of energy supply, improvements in energy efficiency and the electrification of economic activities. While these changes will require unprecedented levels of new investment, it is clear that the 2050 net-zero transition is the cost-minimising course for the global economy.

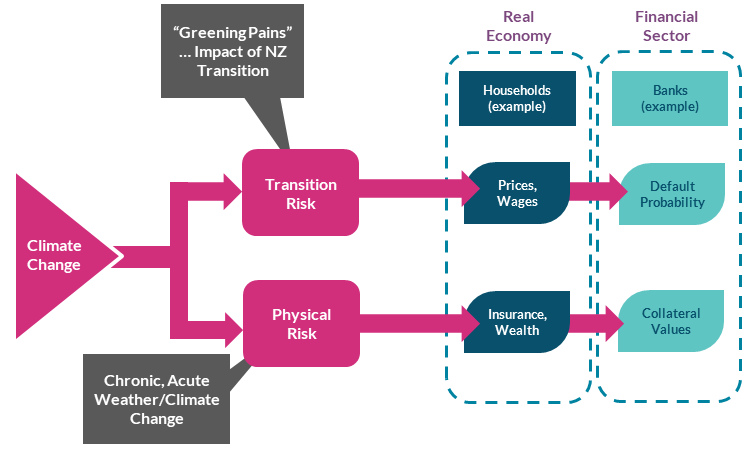

Climate change and the transition to net zero will affect macroeconomic and financial outcomes, altering the underlying structure of economies and exposing financial firms and the financial system to prudential risks. This is why climate change is relevant to the Central Bank’s mission to serve the public interest by maintaining monetary and financial stability while ensuring that the financial system operates in the best interests of consumers and the wider economy.

Physical risks vs transition risks

For the financial system, climate impacts broadly fall into two categories:

- Physical risks arising from direct weather/climate related damages. e.g. wildfires, storms, floods etc.

- Transition risks arising from the costs of implementing net zero policies to transition the economy away from fossil fuels.

It is likely that financial sector impacts will mainly flow through changes in business and household resilience and wealth caused by the materialisation of climate-related risks. For example, the profitability of past bank lending decisions could be affected by changes in collateral values, or by a deterioration in a borrower’s repayment capacity.

For the insurance and reinsurance sectors, unexpected increases in household and business weather/climate-related claims would increase year-on-year profit volatility, while the materialisation of climate risks could also impact the value of assets held by insurance firms.

In the investment funds sector, sudden changes in government policy or increases in environmental sentiment would lead to a carbon-aligned repricing of assets. If asset repricing happened abruptly and rapidly, financial stability concerns could emerge.

The ultimate cost of climate-related risks will depend on the timing and path of transition to net zero. It is clear that early and coordinated international action offers the best route (with governments playing the leading role in altering the path). It is critical that financial institutions understand the risks attached to climate change, taking a broad view on the impacts over a short, medium and long-term horizon, and that they adequately address these risks in a meaningful way.

See also: