Quarterly Financial Accounts

The Quarterly Financial Accounts (QFA) present a complete and consistent set of quarterly financial data for all sectors of the Irish economy. They provide comprehensive information on the financial and investment activities of households, non-financial corporations, financial corporations, government and the rest of the world. The whom-to-whom tables provide information on the interactions between these sectors.

Key Points – Q4 2024

Publication date: 24 April 2025

-

The net financial position of the Irish economy remained positive in Q4 2024, with a net lending position of €3.2bn.

- Non-financial corporations (NFC) saw a 6 per cent increase in total liabilities, primarily driven by equity, which accounted for 61 per cent of the total liabilities.

- Irish financial corporations were net borrowers in the quarter, with the investment fund sub-sector the largest contributor.

- Households net financial wealth increased by €14.6bn during the quarter. This was largely due to a €14.9bn growth in the value of assets, while liabilities remained largely unchanged (-€0.3bn).

- Government debt rose slightly during the quarter (€1.5bn) to stand at €225.9bn. Overall, net financial position of the government improved by €3.8bn, to reach -€105.7bn in Q4 2024.

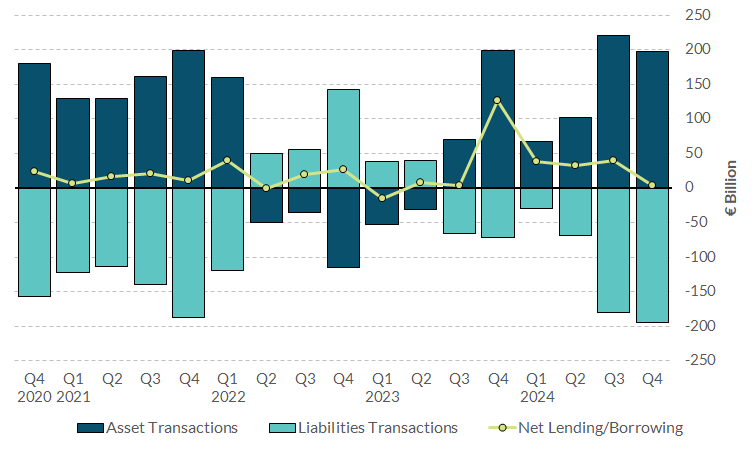

Chart 1: Net Financial Transactions of the Overall Irish Economy

View data for chart 1 | xlsx 21 KB

Overall, the Irish economy remained a net lender in the period, as net investment in financial assets exceeded the net incurrence of financial liabilities by €3.2bn. The main drivers of new investment were transactions in equity and debt securities, while on the liabilities side, transactions were mostly related to investment funds shares and units.

By the end of the quarter, the total stock of financial assets in the economy had risen to approximately €12,555bn, while total liabilities stood at €12,974bn, resulting in a net financial wealth position of -€418.8bn. Financial corporations were the largest contributor to the total balance sheet, accounting for approximately 76 per cent of total assets, with investment funds alone representing 37 per cent of the total.

Chart 2: Borrowing and Lending across Sectors of the Irish Economy

View data for chart 2 | xlsx 16 KB

Non-financial corporations (NFCs) reported the largest positive net financial transactions of each of the four main sectors in Q4 2024. The sector’s net lending exceeded net borrowing by €22.6bn. NFC‘s were net lenders to financial corporations and the rest of the world, while having small net borrowing positions from all other domestic sectors.

As in the previous two quarters, both government and Irish households were net lenders, at €3bn and €5.2bn, respectively. Financial corporations were net lenders to general government but a net borrower from all other sectors. This resulted in an overall net borrowing position of €25.7bn for financial corporations in Q4 2024.

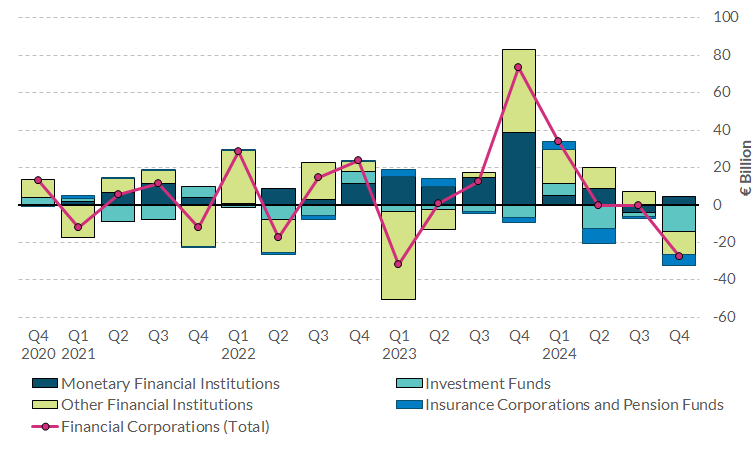

Chart 3: Net Transactions of Irish Financial Corporations

View data for chart 3 | xlsx 21 KB

The investment funds sub-sector, which accounted for 48 per cent of the total financial corporations’ assets and 51 per cent of the sector’s total liabilities, had a net borrowing position of €14.2bn in the quarter. This is a result of large liabilities transactions particularly in non-MMF investment fund shares/units (€99.2bn).

The other financial institutions (OFI) sub-sector was the second largest net borrower in the period, at €12.3bn. This was mainly driven by the captive financial institutions and money lenders subsector, where liabilities exceeded asset transactions by €14.6bn.

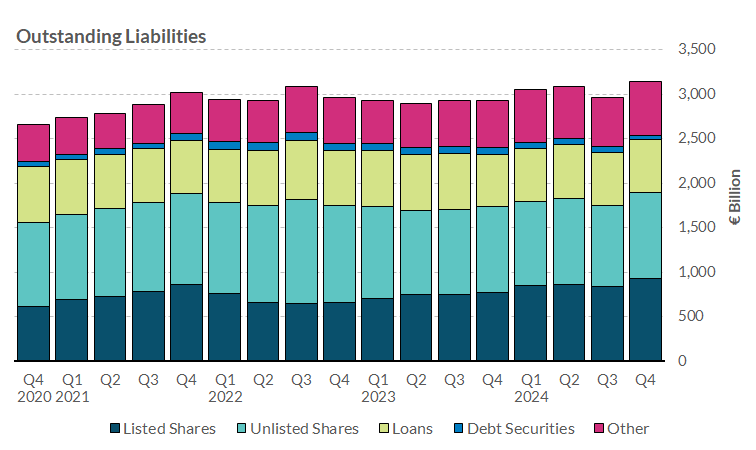

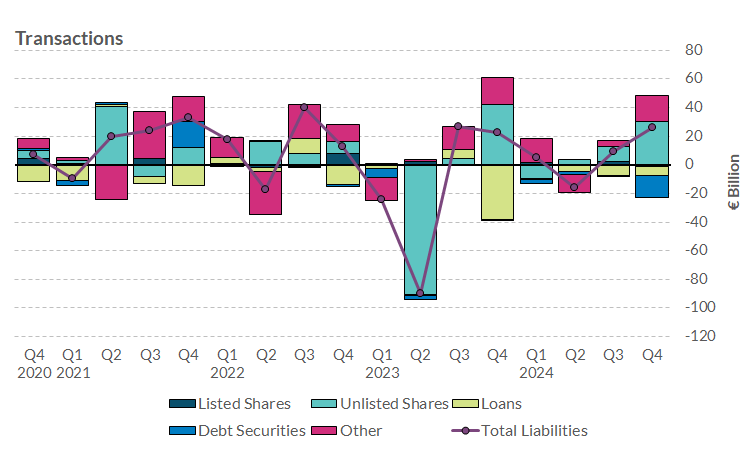

Chart 4: Funding of Irish NFC's and their Liabilities Transactions

View data for chart 4 | xlsx 18 KB

Total liabilities of the Irish non-financial corporation (NFC) sector increased by 6 per cent, reaching €3,139.8bn. Equity remained the main source of funding for NFCs, with listed and unlisted shares amounting to around 61 per cent of the sector’s total liabilities.

NFC total liabilities transactions were positive in the quarter, at €26bn, mainly due to movements in unlisted shares and trade credits and advances. An increase in listed and unlisted shares due to upward exchange rate changes were the main contributors to the overall rise in the stock of NFC liabilities.

Furthermore, NFC debt (loans and debt securities liabilities) stood at €640.3bn in Q4 2024, a €24.1bn decrease from the previous quarter, and equating to 120 per cent of GDP, 8.7 per cent lower than last quarter.

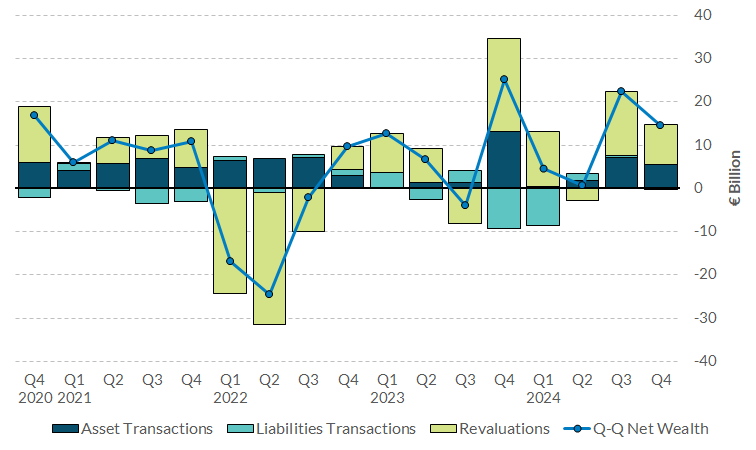

Chart 5: Change in Households' Financial Net Wealth

View data for chart 5 | xlsx 19 KB

Irish households’ financial net wealth increased by €14.6bn in the quarter, to reach €406.9bn.

Household financial assets reached €570.4bn in Q4 2024, with insurance and pension entitlements and currency and deposits the key components of this. These instruments were also key drivers of new financial investment from households, with insurance and pension entitlements increasing by €2.8bn, while currency and deposits assets increased by €2.1bn.

Total liabilities of households were largely unchanged from the previous quarter at €163.6bn, which is almost exclusively made up of outstanding loans. As a whole, the household debt to GDP ratio stood at 30 per cent. Down slightly from the previous period due to the combined movement of a marginal decrease in household debt and an increase in annualised GDP of €17.3bn compared to the previous period.

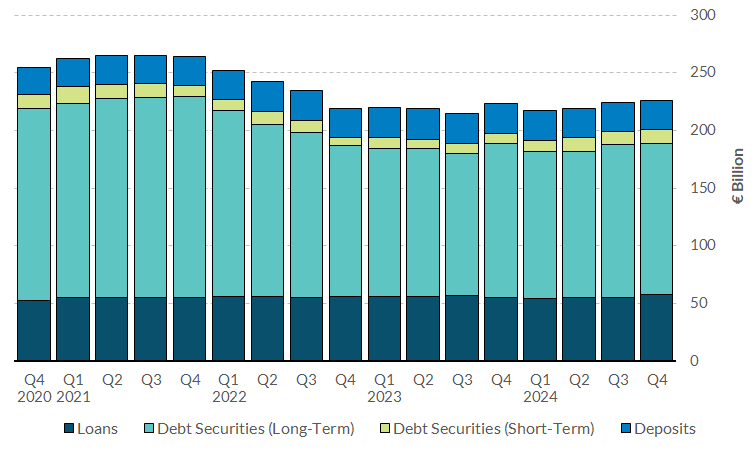

Chart 6: Government Debt and Composition

View data for chart 6 | xlsx 22 KB

Irish government debt increased by €1.5bn in Q4 2024 to stand at €225.9bn.

Government financial assets increased by €4.3bn from the previous quarter, to stand at €137.3bn. The main drivers were debt securities assets, increasing by €20bn from Q3 2024, while accounts receivable/payable and currency and deposits assets reduced by €9.1bn and €7bn respectively. Meanwhile, government financial liabilities remained largely unchanged during the quarter. The combined effect of an increase in assets and relatively unchanged liabilities caused an improvement in the (negative) net wealth position of €3.8bn, to reach -€105.7bn in Q4 2024.

Data

Quarterly Financial Accounts for Ireland Q4 2024 | pdf 507 KB

Financial Accounts for Ireland | xls 33692 KB

Whom-to-whom Tables | xls 26184 KB

Publication Notes | pdf 238 KB

Glossary | pdf 426 KB