Pension Fund Statistics

Balance sheet (assets and liabilities) data for pension funds resident in Ireland (ESA 2010 sector S129) consists of financial corporations that principally engage in financial intermediation as a consequence of pooling social risks and providing for income in retirement. In Ireland, a pension fund is an autonomous occupational pension scheme established under trust.

Key Points - Q4 2024

Publication Date: 21 March 2025

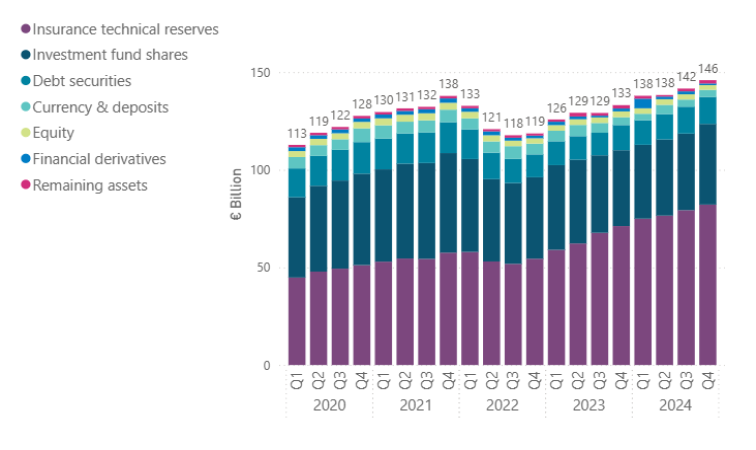

- Total assets of the Irish pension fund (PF) sector increased by 3 per cent in Q4 2024 to stand at €146 billion (Chart 1). This was driven by a continued upward trend in insurance technical reserves (ITRs) 1, which grew by 3.6 per cent (€2.8 billion) over the quarter.

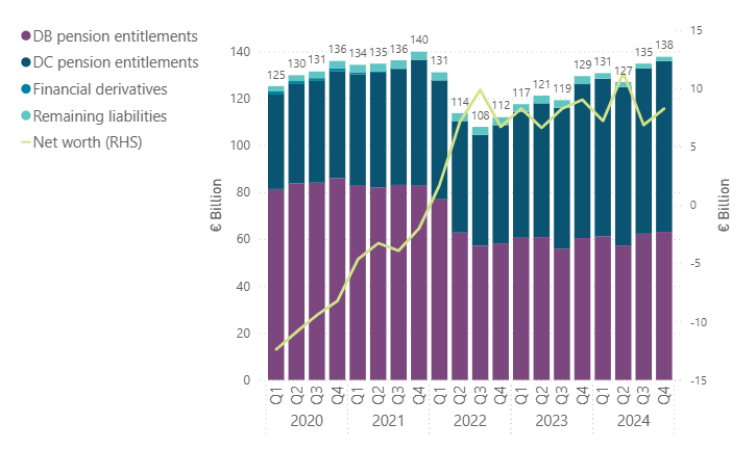

- Technical reserves relating to pension entitlements increased by 2.3 per cent in Q4 2024 to stand at 136 billion (Chart 2). This was driven by a growth in defined contribution (DC) technical reserves of 3.3 per cent alongside a growth of 1.3 per cent in defined benefit (DB) technical reserves2.

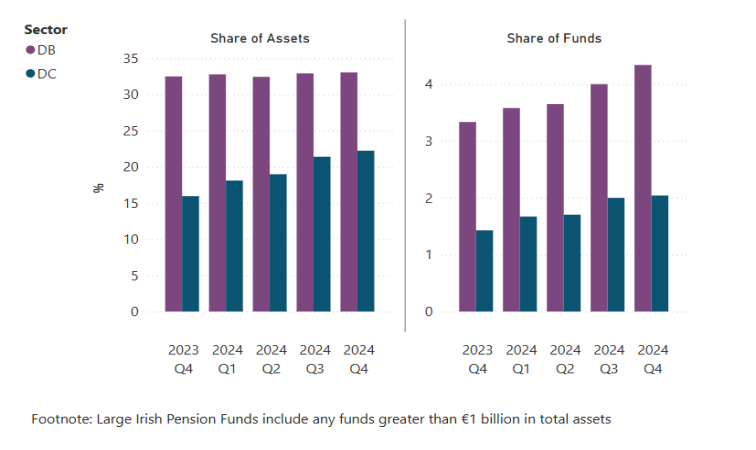

- Pension funds with a total asset value greater than €1 billion account for the majority of pension fund assets (55 per cent) and 6.4 per cent of the total number of funds (Chart 3). Of this 6.4 per cent, 4 per cent are in the defined benefit (DB) sector, while the defined contribution (DC) sector accounts for 2per cent. While both sectors has seen an increase in their number of funds with total asset value greater than €1 billion compared to Q4 2023, the DC sector has experienced a larger overall increase in total asset value.

Summary Charts

Chart 1: Assets of Irish pension funds

Chart 2: Liabilities of Irish pension funds

Chart 3: Assets of Irish pension funds (by subsector)

Notes

[1] In the pension funds context insurance technical reserves (ITRs) are assets relating to claims on insurance corporations by pension funds (also known as pension fund reserves) while pension entitlement technical reserves are liabilities relating to claims on pension funds by households.

[2] Defined benefit technical reserves includes hybrid schemes. Technical reserves are valued on an accounting standard basis. Defined benefit technical reserves and net worth are reported on an annual basis (at year end), values for other quarters are estimated and subject to revision on receipt of latest annual data.

Explanatory Notes Pension Fund Statistics | pdf 281 KB

Pension Fund Statistics | xls 34 KB