Behind the Data

Green Bonds: A Snapshot of Global Issuance and Irish Securities Holdings

Siobhán O’Connell*

May 2021

The fast-growing green finance sector has an important role to play in the wider climate change response. In this Behind the Data we use data from both Central Bank and commercial sources to examine trends in the European green bond market and reveal who the main holders of green bonds in Ireland are.

In recent years, the severity and frequency of events linked to climate change have been on an upward trend. Companies and governments have begun to take steps in their approach to financing green initiatives and supporting climate-related infrastructure (such as clean energy production) through the issuance of green bonds and other sustainable financial instruments.Central Bank of Ireland and the European Central Bank, amongst others, have highlighted the challenges and channels, through which climate change impacts on the financial system.

There are two highlighted risks (Lane, 2019):

- Physical risk: referring to direct losses caused by climate events

- Transition risk: the impact of a sudden and unanticipated transition towards a low-carbon economy, and its impact on financial assets and economic stability

Climate change has the potential to affect the core mandate of central banks and their role within the financial system (Lane, 2019). Analysis of broader financial risks must incorporate climate change (BIS, April 2021) and developments in sustainable financing markets. Therefore, the impact of climate risk is increasingly part of the activities of central banks from the supervision of firms, to financial stability, and risk assessments. For example, as part of the ongoing ECB monetary policy strategy review, the ECB is considering “how the issue of climate change and the fight against climate change can actually have an impact on our policies”. Furthermore, the Network for Greening the Financial System, of which the Central Bank is a member, is a group of central banks and supervisors that share best practices and contribute to the development of environment and climate risk management in the financial sector.

This Behind the Data focuses on an important area of sustainable financing, green bonds. The issuance of green bonds has clear benefits for issuers both corporate and sovereign; such financing assists the transition to a greener business model, which will mitigate the effects of climate change. For experienced debt issuers, it leverages their existing debt financing processes. Using survey evidence, Sangiorgi and Schopohl (2021) show that investors are attracted by pricing, good quality green bond credentials of issuers and green investment mandates in this space.

Given current data gaps, existing Central Bank data are matched with commercial sources in this Behind the Data to allow for the monitoring of the green bond market. First, the trends in the European green bonds market are examined before then examining Irish resident green bondholders.

The Data

As defined by the International Capital Market Association, green bonds are “any type of bond instrument where the proceeds will be exclusively applied to finance or re-finance, in part or in full, new and/or existing eligible green projects”.

The green bond market is small but growing (ECB, FSR Nov 2020). Data gaps and expertise in a new market are challenges for analysts and market participants. Existing datasets (ESRB, 2020) provide some measure of climate risks but more development of granular data can further assist this area of analysis. Work underway by the European Union to bridge data gaps includes requirements for companies to both disclose their sustainability risks and impacts, make disclosures when selling sustainable financial products and the formalisation of the green finance taxonomy. The formalisation of the European green bond standard will provide clarity and standardisation to wider stakeholders. Market participants will need to grow their capacity to manage the green bond process (Deschryver and de Mariz ,2020).

Official statistical datasets do not yet have an internationally agreed framework for identifying green bonds and therefore there is a reliance on using commercial data sources. This Behind the Data uses Refinitiv’s active green bonds list, which considers a security to be green if it is labelled by the issuer as such, and is issued based on a green bond framework established/adhered to by the issuer. The green bonds list is then cross-referenced against the Eurosystem’s Centralised Securities Database and the granular securities holdings database for Irish residents. The list of green bonds were taken as at April 2021 from the commercial data provider. There are alternative providers of equivalent data. For example, work by Deutsche Bundesbank uses Bloomberg, similarly the ECB has referred to both sources in their work.

An overview of the green bond market

The issuance of green bonds has increased rapidly across all sectors globally in recent years. In a recently published climate data dashboard, the IMF highlights that cumulative global green bond issuance stood at $1,044 billion at end-2020, with the euro area accounting for around 41 percent of all green bond issuance. Similarly, the Network for Greening the Financial System highlights the strong issuance of green bonds globally during 2019 and 2020.

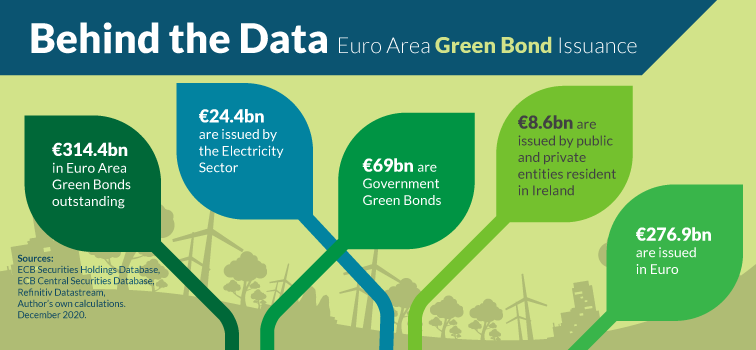

Using the Refinitiv active green bond list and matching it with the ECB’s Central Securities Database, we find that euro area outstanding amounts of green bonds increased from €72.7 billion at end-2017 (0.4% of total euro area debt securities) to €314.4 billion at end-2020 (1.7% of total euro area debt securities). The tree below provides a snapshot of the euro area green bond issuance market as at end-2020. Irish issuers account for 2.7 % of euro area issuance outstanding, while green bond issuers in France, the Netherlands and Germany combined account for some 75% of the amount outstanding at end-2020. The vast majority of euro area issuance, some €276.9 billion, is denominated in euro, with a euro equivalent of €37.5 billion issued in foreign currency.

Credit institutions represent the largest green bond issuing sector in the euro area, with €95.6 billion outstanding as at end-2020. Proceeds are used, among other things, to finance improvements in energy efficiency of pre-existing buildings. Non-Financial Corporates accounted for 26.4 percent or €83 billion of the total issuances; within this €24.4 billion was issued by the electricity sector alone. Government issuance of green bonds stood at €69 billion, of which the Irish Sovereign Green Bond accounted for €6.1 billion. Some 32 percent of outstanding euro area issuance at the end-2020 was originated during 2020. The average issue size per green bond was €325 million during 2020.

The Irish government green bond

Irish issuance of green bonds has been dominated by the Irish sovereign green bond, which accounts for 72% of Irish outstanding issuance at end-2020. The first, and to-date only, Irish sovereign green bond came to market in 2018, with an issuance size of €3 billion and a 2031 maturity. Subsequent taps of this bond in 2019 and 2020 raised an additional €2 billion and €1 billion respectively. This issuance had the stated purpose of funding eligible green projects. The NTMA’s “Irish Sovereign Green Bond Framework” underpins its activity in this space, while the agency publishes an annual “Allocation Report”, and in 2020, the NTMA published its first “Impact Report”. The Irish Green bond issuance is one of seven other euro area governments who also have issued green bonds in recent years. Further, under the recovery package passed last year, around 30 % of the €750 billion Next Generation EU recovery fund will be raised via green bonds (2021-2026).

The government green bond market is in its infancy but with increasing issuance and existing security-level datasets, deeper analytics will be possible.

Irish holders of green bonds

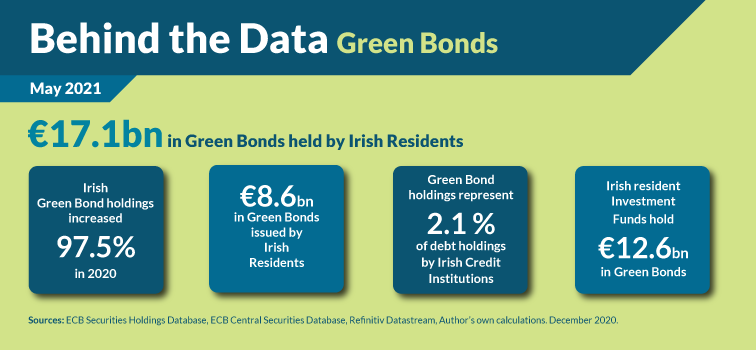

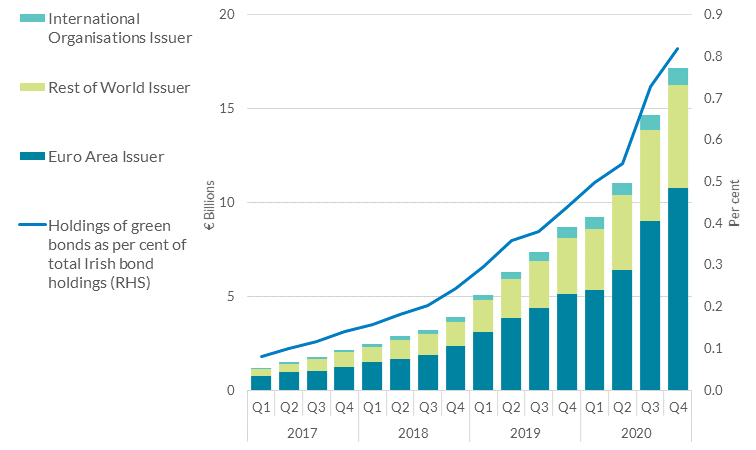

Since 2017, there has been increased appetite among Irish resident entities to hold green bonds. Whilst representing a relatively small share of overall holdings, at just 0.8%, this asset class is quickly growing in prominence, with €17.1 billion held as at December 2020 (chart 1). Transactions accelerated towards the end of 2020, with Irish investors undertaking some €3.5 billion of net transactions in Q3 2020.

Chart 1: Evolution of holdings by Irish residents of green bonds

Source: ECB Securities Holdings Database, Refinitiv Datastream

Notes: The Securities holdings figures exclude Central Bank of Ireland holdings of Green Bonds.

International organisations are entities created by treaty involving several nations, the issuer of Green bonds are largely international development banks.

Data extracted from Refinitiv Datastream April, 2021

In relation to the geographic dispersion of issuers, French, Dutch, Irish, American and German resident green bond issuers account for 56% of Irish resident holdings. The residual issuers are spread across some 55 countries and international organisations.

Meanwhile, there is an even spread across issuer sectors with no strong preference for any particular sector. The Irish sovereign green bond accounted for 9 % of Irish residents’ green bond holdings. The electricity and energy sector accounted for €1.5 billion or 9% of Irish green bond holdings. In terms of maturity of this debt, some 41% has an original maturity of between 5 and 10 years.

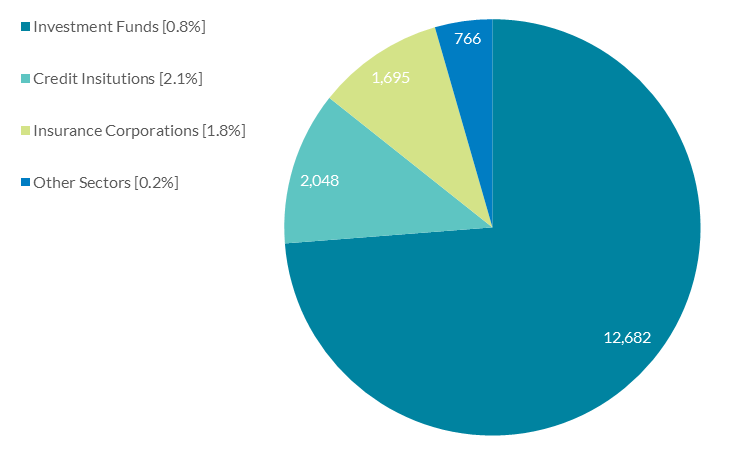

By sector, Irish resident investment funds hold the most green bonds, with €12.6 billion (or 74% of total green bond holdings) of holdings at end-2020 (Chart 2). Credit institutions are the second largest holder, followed by insurance corporations. This is broadly in line with trends in other euro area countries (Deutsche Bundesbank, 2019). Irish credit institutions held 2.1 % of their debt holdings in green bonds at end-2020, a relatively large share compared to other sectors.

Chart 2: Irish resident holdings of green bonds (€ million) and percentage holding of total debt holdings, Q4-2020

Source: Securities Holdings Database, Refinitiv Datastream

Notes: Data are outstanding holdings of Green bonds. Percentage figures in brackets represent green bond holding as percent of Total Debt Holdings for that holder sector.

Data extracted from Refinitiv Datastream April, 2021

Conclusion

Along with other sustainable finance instruments, the green bond market will be key to funding the delivery of climate goals and mitigating potential economic and financial losses. The market for green bonds is growing, but is still relatively young and small in size compared to the overall bond market. There are also gaps in the data that preclude a rigorous analysis at present. However, to support analysis in this area, initial green bond indicators are presented in this Behind the Data.

Globally, issuance of green bonds has experienced strong growth in the last two years, with €8.6 billion of Irish issuance of green bonds outstanding at the end of 2020. Irish resident investment funds were the largest holder of green bonds in Ireland. Green bond holdings represented 2.1% of debt holdings by Irish credit institutions.

The issuance of green bonds and the ongoing formalisation of green finance taxonomies will provide all stakeholders with greater clarity. Investor holdings can be monitored in existing datasets as discussed above. This will provide for deeper climate risk analysis as this market develops.

*Email [email protected] if you have any comments or questions on this note. Comments from Mark Cassidy, Patrick Haran, Yvonne McCarthy, Rory McElligott, Caroline Mehigan, Seamus Ruddy, Alexander Steuart and Maria Woods are very gratefully acknowledged. Thank you to Naomi Kelly, Bernard Kennedy, Garreth McEvoy, Caolán McLaughlin and Breda McLoughlin for assistance and colleagues at the Deutsche Bundesbank for their time in presenting their work on green bonds to the Statistics Division. The views expressed in this note are those of the author and do not necessarily reflect the views of the Central Bank of Ireland or the ESCB.

See also: