Behind the Data

How choice of definition alters the role of SPEs in Ireland

Daniel Martin *

August 2024

The structure and purpose of special purpose entities (SPEs) can vary substantially in different countries. This makes having a harmonised definition challenging. This Behind the Data (BtD) illustrates these challenges and articulates some key differences between the definitions currently in use. We identify orphan entities as a key driver of the differences, affecting both the size and composition of the aggregate SPE balance sheet. Any definition which excludes Irish orphan entities would notably alter conclusions around the prevalence and importance of SPEs in Ireland.

In the modern global economy, complex corporate structures that cross multiple borders and often include SPEs have emerged. SPEs are particularly relevant for Ireland, highlighted by SPE statistics published by Central Bank of Ireland which shows total assets of resident SPEs were €1,103bn at end-2023, having risen by €33bn year-on-year. This increasing prevalence of SPEs highlights the importance of understanding what is and is not included under different SPE definitions and how that may alter interpretation of the data and conclusions. It also underlines the benefits of improved coverage, as recommended by the IMF’s financial system stability assessment for Ireland.

SPEs may be set up for financing purposes and are often part of the wider non-bank financial intermediation, where bank like activities take place outside the traditional banking sector (See NBFI and Golden and Maqui, 2018 (PDF 520.69KB)). SPEs may also be set up to hold certain assets or liabilities and seeking the benefits of different tax, accounting and supervisory regulations under different legislations and providing access to financial markets. SPEs may also manage intellectual property rights, research and development, trade and other services as part of a multinational enterprise structure.

The IMF describe the objectives of an SPE as (i) access to capital markets or sophisticated financial services, (ii) isolating owners from financials risk, (iii) reducing regulatory and tax burden, and (iv) safeguarding the confidentiality of their transactions and owners.

The IMF have also developed the following criteria to identify SPEs; the entity being formally registered and/or incorporated resident institutional unit, with little or no employment up to a maximum of five employees, no or little physical presence, no or little physical production in the host economy, directly or indirectly controlled by non-residents and transacting almost entirely with non-residents, having a large part of their financial balancing sheet consisting of cross-border claims.

For the SPE split out within Balance of Payments (BoP) statistics the criteria that an entity be controlled by non-residents is crucial as it means the SPE is classified as an institutional unit and not consolidated within the accounts of its parent (in line with BPM6 section 4.52).

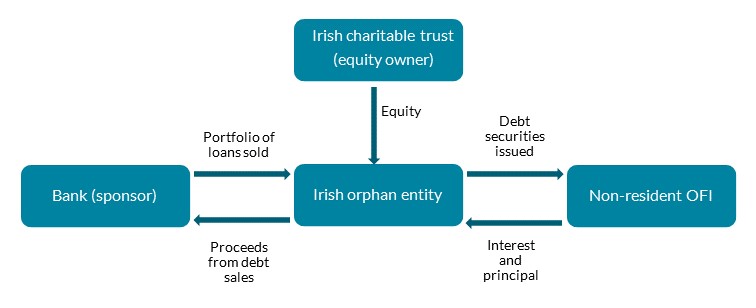

Figure 1: Orphan Entity Example

These IMF criteria have been agreed subsequent to the Central Bank starting to collect SPE data under a national definition, although many of them do overlap with those applied under the Irish national definition. However, the Irish SPE population includes entities referred to as “orphans”. Figure 1 illustrates an example orphan entity structure. While a charity or other body technically owns the equity in the entity, the sponsor, shown in the example as a bank, is the beneficiary and controls decision making. Thus the sponsor entity more closely fulfils the “parent” role in this group structure than the equity owner. In the example, the orphan entity issues debt securities which are purchased by a non-resident other financial intermediary (OFI) but other cases could apply.

At a European level, the structure of these Irish orphan entities was explored in detail and it was agreed that Irish orphan entities should be included in the ECB SPE data collection within BoP, where all the other IMF SPE criteria are met and the entities have a non-resident sponsor. This ECB collection allows for detailed cross country comparisons, especially amongst countries where SPEs are particularly relevant.

In the discussion which follows, we include an “adjusted IMF definition” which reflects this European interpretation as well as the Irish national definition and the IMF definition. This allows us to identify how the various definitions of SPE change the size and composition of the aggregated SPE balance sheet in Ireland and the role of orphan entities in this change. Key differences between the three definitions discussed are detailed in table 1 below.

Table 1: Criteria applied by each potential SPE definition

| Criteria | Irish National Definition | Adjusted IMF Definition | IMF Definition |

|---|

| Registered with the Central Bank of Ireland as an SPE | Yes | Yes | Yes |

| Entity has fewer than five employees | Yes | Yes | Yes |

| Entity has little/no physical presence or production in the host economy | Yes | Yes | Yes |

| Includes orphan entities where all other criteria are met | Yes | Yes | No |

| Includes entities with an Irish resident sponsor | Yes | No | No |

| Requires entities to transact almost entirely with non-residents | No | Yes | Yes |

The data

The time series for SPE statistics that the Central Bank collects following the Irish national definition began in 2015 Q3. The population is based on financial vehicle corporations (FVC) data collected under ECB regulation ECB/2013/40, which is available from 2009 Q4 and non-securitisation special purpose vehicles (SPV) collected where entities avail of Section 110 of the Taxes Consolidation Act, 1997. The two subgroups of FVCs and SPVs make up the SPE reporting population in Ireland.

Given that in the BoP context only entities with non-resident parents are relevant, it is essential to remove Irish sponsored entities from our published statistics to allow direct comparison between the definitions. In Q4 2023 this reduces total SPE assets by ten per cent to €989.1bn. In the remainder of this BtD the term “national definition” refers to the Irish national SPE definition but with this adjustment for national ownership.

As well as the information provided when statistical data is submitted to the Central Bank, we can use information provided by SPE administrators upon registering with the Central Bank to apply the additional IMF criteria and facilitate cross-definition comparisons.

Total assets under each definition

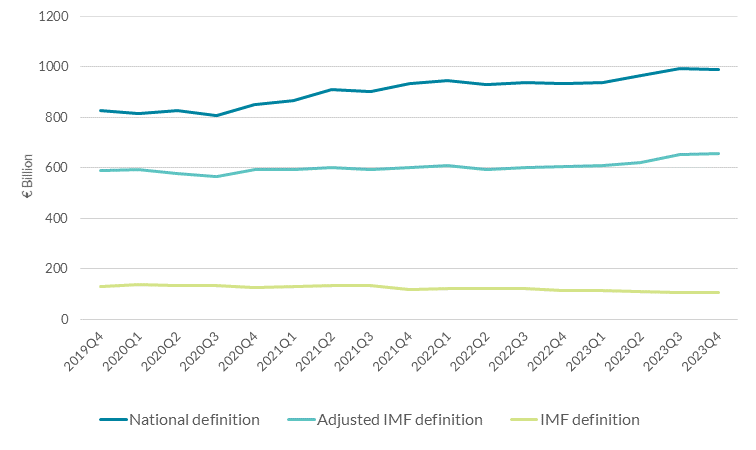

Chart 1: SPE Total Assets under Each Definition

Source: Central Bank of Ireland, and author calculations.

Chart 1 shows that total assets under the IMF definition were around 11 per cent of the national definition value in 2023Q4. The key driver of this difference is the removal of orphan entities which accounted for 78 per cent of total SPE assets under the national definition. This share has risen from 71 per cent of assets in 2019 Q4.

Total assets under the adjusted IMF definition were €655.3bn in 2023 Q4, still only 66 per cent of the national definition. This remaining difference is due to the criteria under the IMF definition that an SPE transact almost entirely with non-residents. In the European context this criteria has been interpreted as requiring 80 per cent of total assets and liabilities vis-à-vis non-residents to ensure a harmonised approach by euro area member states. The other SPE criteria outlined by the IMF are consistent with those applied for the national definition and thus do not contribute to differences.

The role of orphan entities and how they differ from non-orphan SPEs

Chart 2: Total SPE Assets by Vehicle Type, National Definition

Source: Central Bank of Ireland, and author calculations.

Collateralised loan obligations and asset backed security vehicles account for 22 per cent and 19 per cent of total assets respectively, Chart 2 shows how this concentration has increased in recent years. However, both of these vehicle types are dominated by orphan entities and when only the non-orphan population is considered (as per the IMF definition), investment fund linked vehicles account for the largest share. Both collateralised loan obligation and asset backed security vehicles account for less than ten per cent of total assets within the non-orphan population.

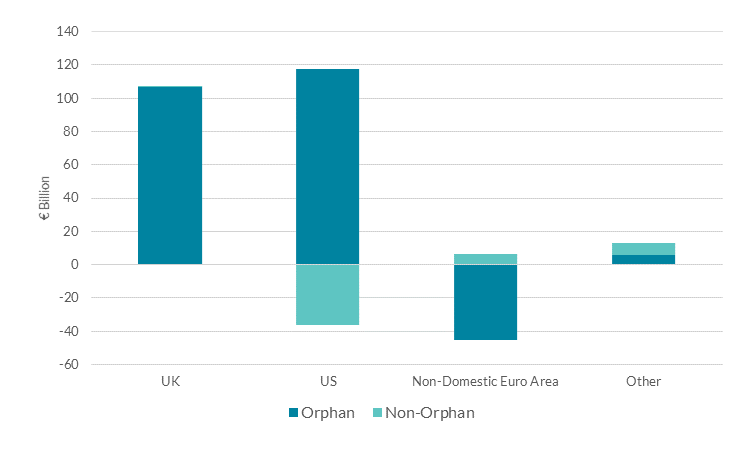

Chart 3: Change in total assets by sponsor country, 2019 Q4 - 2023 Q4

Source: Central Bank of Ireland, and author calculations.

The geographical breakdown of sponsors also differs between orphans and non-orphans. UK sponsored entities accounted for 40 per cent of total orphan entity assets, nine per cent more than their share for non-orphan entities. US sponsored entities account for 29 per cent of total orphan assets at end 2023 and Chart 3 shows that growth in assets of SPEs with US sponsors since end 2019 has all come via orphans, with non-orphan US sponsored SPEs seeing total assets decline over the same period. This highlights that the choice of SPE definition could notably alter inter-country links depending on whether orphan entities are included within the population. It is also important to note that an SPE may have immediate links to countries other than that of the ultimate sponsor which can make country links more complex.

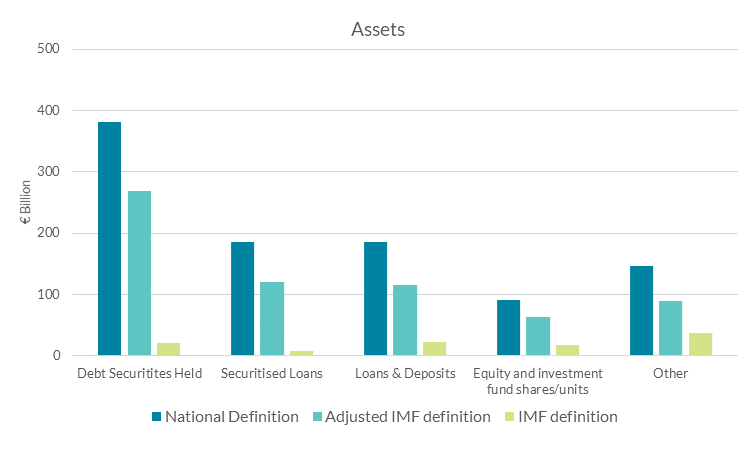

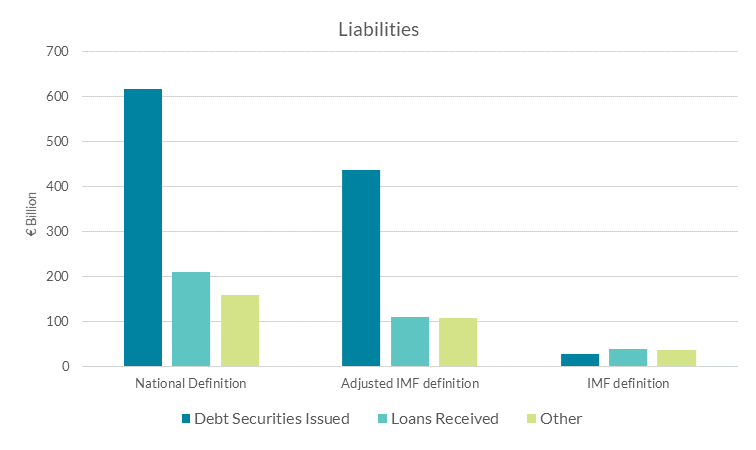

Chart 4: SPE balance sheet composition, 2023 Q4.

Source: Central Bank of Ireland, and author calculations.

As well as altering the total size of the SPE balance sheet, definition choice influences the composition of the balance sheet. Debt securities account for the largest share of total SPE assets under the national definition and the adjusted IMF definition, with 39 and 41 per cent respectively. However, Chart 4 highlights how this varies depending on definition. Under the IMF definition, loans and deposits are the most prevalent instrument. Likewise SPE liabilities are concentrated in debt securities under the national and adjusted IMF definition but this share is notably reduced under the IMF definition, with loans accounting for a larger share. On both sides of the balance sheet, the exclusion of orphan entities under the IMF definition is the key driver of the differences.

Conclusion

Over the past number of years there has been significant progress made internationally in developing a cross country comparable definition of SPEs to enable a better understanding of these entities, particularly in the context of BoP. Definitions do vary though, and in this BTD we illustrate the importance of including orphan entities to ensure any Irish SPE figure is a closer representation of the population within the country and analytically useful to users of published statistics.

*Email [email protected] if you have any comments or questions on this note. Comments from Arya Pillai, Simone Saupe, Jenny Osborne-Kinch, Jean Cassidy and Robert Kelly are gratefully acknowledged. The views expressed in this note are those of the authors and do not necessarily reflect the views of the Central Bank of Ireland or the ESCB.

See also: