Behind the Data

Shining a light on sectoral spending behaviours through the most recent phases of the pandemic

Andrew Hopkins and Martina Sherman*

February 2021

New high frequency sectoral data from October highlight the swift change in consumer spending patterns as public health restrictions changed. Consumers quickly went online when shops closed, and immediately availed of hospitality services when they reopened in early December. February data highlight a return to similar spend levels as that of the previous Level 5 period.

The COVID-19 pandemic and ongoing public health restrictions have a dramatic effect on our day-to-day lives, along with a significant impact on how we spend and save our money. Understanding how and where consumers spend during future restriction changes is important, due to the significant impact of spending, and in turn consumption, on Ireland’s economic

growth. Recent research shows how high frequency data can be used to track developments in consumption and so to more accurately examine the impact of the pandemic on economic output.

This “Behind the Data” uses new data, capturing over 90 per cent of the card payments market, to explore how the recent change in restrictions affected our day-to-day spending in the most impacted sectors since the move to Level 5 restrictions in October. Data is published weekly on the Central Bank website, with a sectoral split available from October 2020.

The latest data up to mid-February, show that spending has broadly reverted to levels seen in October’s Level 5 period for all sectors, except for ‘other retail’, which is lower than October as this included the build up to Christmas for retail spending. The benefit of this high-frequency granular dataset is highlighted when viewing the changes in sectoral spending that occurred when restrictions changed in October and December.

We find that the hospitality sectors of restaurants and accommodation experienced the largest declines in spending when more stringent restrictions were re-introduced in October, but equally benefited the most immediately upon the easing of restrictions before the Christmas period. We see an instant switch to online shopping on the day that in-store purchases were curtailed, helping to partially mitigate the closure of non-essential retail businesses. The data also show that people were very willing to spend throughout December and particularly in the run-up to Christmas, confirming retail spend expectations for December, and findings from the CSO’s recent ‘Social Impact of COVID-19’ survey.

The Data

Our enhanced high-frequency data, are an expansion of the daily card payments dataset, developed in the early stages of the pandemic. These provide a valuable addition to the Central Bank’s new experimental data series and recent joint work, established in response to the Covid-19 pandemic.

The data are representative of the full Irish market, covering all major entities in the Irish debit and credit card market. The daily series accounts for over 90 per cent of all card transactions by volume and value. It excludes a small number of entities with smaller market share. The dataset consists of total debit and credit card spending and ATM withdrawals, while from 1 October 2020, expenditure in a number of key sectors of the economy, and a split of online and in-store spending is available.

The sectoral breakdowns are:

(i) Groceries, (ii) Other retail (excluding groceries), (iii) Transport, (iv) Accommodation, and (v) Restaurants (inc. pubs).

These specific sectors were identified to allow us to examine the economic impact on the consumer facing sectors that are most impacted by the pandemic. The data are a more timely subset of the long-standing monthly Credit & Debit Card Statistics, thereby allowing for historical comparisons.

Restaurant and dining sectors see largest spend increase upon restriction easing

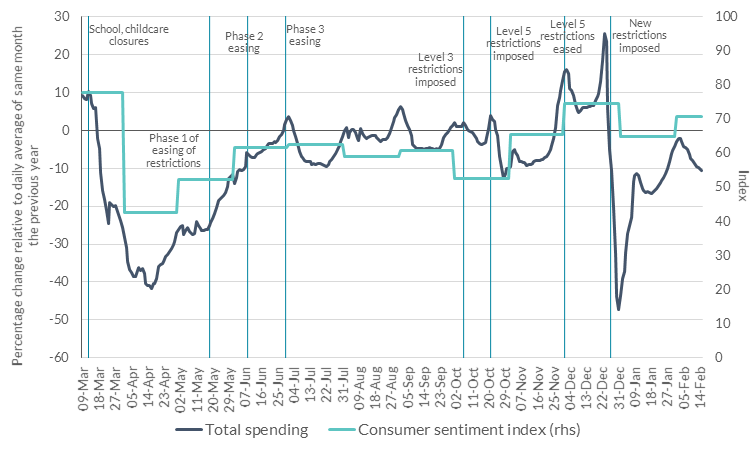

The impact of the public health restrictions on spending are visible in existing headline Central Bank daily card payments statistics (Chart 1), where a number of similarities and differences across the restriction periods are observable. There tends to be an increase in spending in the days prior to restrictions being introduced, as households prepare for the increased restriction measures, with a subsequent sharp decrease as measures take effect. Spending appears to track the monthly consumer sentiment index. The new data, available from 1 October 2020, now allows us to analyse which sectors are most impacted as we move through restriction phases and consumer sentiment varies.

Chart 1: Real-time impact of fluctuating restrictions on spending behaviour

Source: KBC Irish Consumer Sentiment Index, Central Bank of Ireland daily card spending data Table A.13.2.

The period covered by the new data is of particular interest as it covers the tightening of restrictions in the late autumn, the relaxation leading up to the Christmas period and the subsequent reimposition of restrictions in late-December. It is worth noting the sharp decline observed after Christmas was driven by a number of factors in addition to the introduction of public health measures. These are seasonal factors, the impact of weekends, and the impact of public holidays; all of which contribute to lower spending.

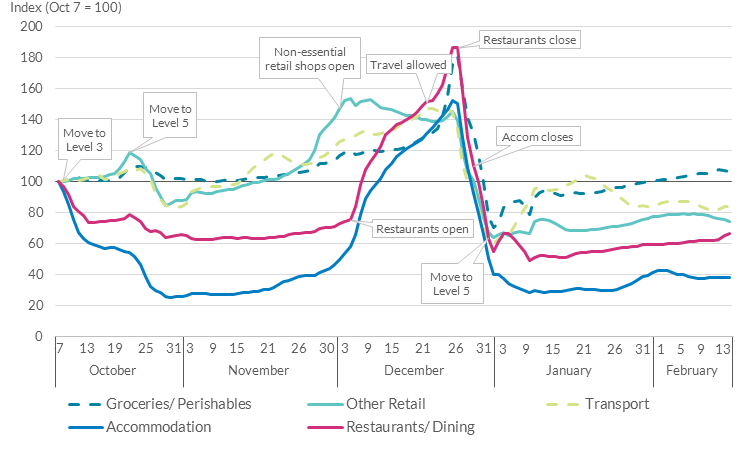

The hospitality sectors of restaurants and accommodation saw the immediate impact of the restrictions introduced during October, with a significant contraction in spending as business was restricted to takeaway service only, as evident in Chart 2. Once the sectors reopened on 4 December, expenditure in the restaurants sector picked up sharply over the following fortnight, up almost 94 per cent, or €79 million, compared to the fortnight previous. A similar trend is evident in the accommodation sector, where most hotels also offer food, with spending up 141 per cent over the same fortnightly period.

The level of restaurant spending continued to increase right up to 19 December when the daily spend peaked at €19.6 million, a 259 per cent increase on the average daily spend in November. Spending once again declined dramatically after Level 5 restrictions were re-introduced in late-December. Overall, spending in the restaurant sector in a volatile December ended at 21 per cent or €86.6 million below December 2019 levels. As expected, spending up to mid-February has fallen back markedly with the closure of the sector again.

Lower spending in these sectors is noteworthy, but unsurprising, as so called ‘wet bars’ remained closed and social distancing restrictions constrained capacity within indoor dining settings during the period, and as some consumers refrained from returning to indoor dining settings altogether.

The new granular data provides additional insight into inter-day spending during the month, and this information is now available with a lag of 4 days.

Chart 2: Changes in sectoral spending

Source: Central Bank of Ireland Table A.13.2, 7-day moving average, author’s calculations.

Note: The sectoral breakdown is compiled referencing the merchant category code (MCC) system for retail financial services. The MCC is used to classify the business by the type of goods or services it typically provides.

Noteworthy over the October 2020 to February 2021 period, is the minimal impact of the changing restrictions on grocery spending, which remains relatively consistent throughout October and November. There is an unsurprising gradual increase from late-November leading up to Christmas, the spend on groceries peaked noticeably in the two-day period prior to Christmas Eve, accounting for 12 per cent of the total December grocery spend, or €189 million. Grocery spending then returns gradually to pre-December levels over January and February, where Level 5 restrictions are in place. While grocery spend typically increases each December, the 2020 grocery spend was significantly higher than previous years, presumably related to the subdued spend in restaurants and hotels compared to December 2019. The latest data for January and the first half of February indicates that spending in this sector remains significantly higher than pre-pandemic levels.

A combination of the lifting of restrictions in early-December and Christmas preparations saw strong willingness to spend across all sectors in the run-up to Christmas. This corroborates the strong consumer sentiment index reading in December, which increased to its highest level since the previous March. A recent IBEC report also pointed to the expectation that households would spend broadly as much on retail goods over Christmas 2020 as in other years.

The latest data, up to 15 February 2021, show that spending in most sectors remain below the daily average for February 2020, with the exception of groceries and ‘other retail’ spending. The accommodation sector spend is highly subdued, at just 19 per cent of its February 2020 daily average, while spending on transport and restaurants are at 20 and 54 per cent of their respective levels.

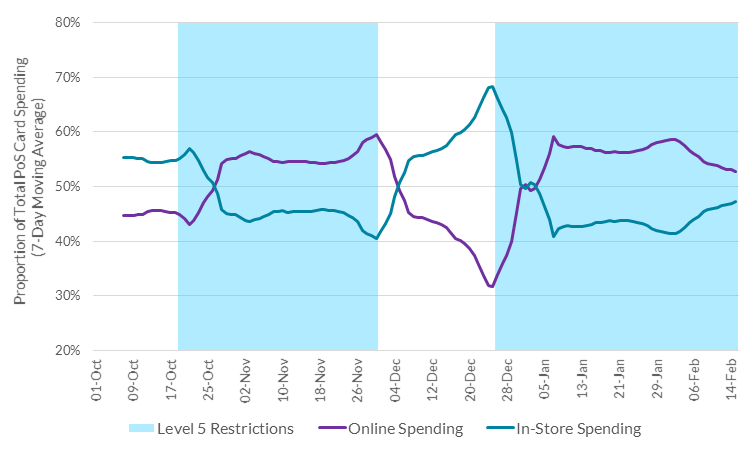

Online sales accelerated once Level 5 restriction measures were imposed

From mid-October, a clear change in the proportions between online and in-store spending occurs, with a substitution effect from in-store to online spending, as restriction measures reduced the opportunity for in-store spending (Chart 3). Online spending settled at circa 55 per cent of all point of sale spending through much of November when Level 5 restriction measures were in place, and rose to 60 per cent in the final days of November, coinciding with the Black Friday/Cyber Monday sales weekend.

While a breakdown of online spending by sector is not available, using Chart 2 we can infer a strong impact of online spending on certain sectors. For instance, while the ‘other retail’ sector experiences a decline in spending following Level 5 restrictions during October, it is not as severe a contraction as the reduction experienced by other consumer-facing sectors, despite non-essential retail shops being closed. It is also evident that spending activity in this sector increases in advance of the easing of restrictions in early-December, likely boosted by the Black Friday/ Cyber Monday online sales events.

Although not a solution for all businesses, as the pandemic affects sectors differently, the ever-improving presence and availability of online retail (essential and non-essential), has likely supported spending in the sector.

Chart 3: Online and in-store spending

Source: Central Bank of Ireland Table A.13.2, author’s calculations.

Following the relaxation of restrictions in early-December, the share of in-store expenditure rose sharply. In-store received a further boost in the days prior to Christmas Day, most likely related to the sharp rise in grocery and ‘other retail’ shopping, and with delivery timeframes around Christmas rendering online shopping impractical.

Conclusion

Using enhanced high-frequency sectoral data, which captures over 90 per cent of the card payments market, this “Behind the Data” presents insights into the daily spending patterns impacting key sectors of the economy as the country went through various stages of public health restrictions in late-2020 and early-2021. The additional high-frequency sectoral data complements existing headline spending data and allows for a closer monitoring of personal expenditure in the most impacted sectors, providing close to real-time information on policy decisions. This high frequency sectoral data will be especially valuable to policy makers and analysts to monitor sectoral activity as restrictions are eased in the future.

Utilising new data from 1 October 2020, we can quantify the immediate recovery in spending in the restaurant and dining sector when restrictions were eased in early December, and equally observe the dramatic fall upon their re-introduction in late-December. However, this has not been enough to allow spending in the sector to return to 2019 levels, with capacities constrained by social distancing measures and certain cohorts of the sector forced to remain closed throughout the period. The latest data up to mid-February, show that spending has broadly reverted to levels seen in October’s Level 5 period for all sectors.

We also see the rise in online spending, which currently accounts for the majority of point of sale card spending, as restrictions measures are imposed and the opportunity for in-store spending is reduced, while as restrictions are eased in-store spending increases rapidly. The hospitality sectors, such as restaurants and dining, and the accommodation sectors are disproportionately affected by the imposition of restrictions, while sectors such as ‘other retail’ are affected, but to a lesser extent.

Given that restrictions, of one form or another, have been in effect since the beginning of the pandemic and are likely to be a feature for some time to come, the data provide useful insight into the degree of change in consumer spending behaviour. The proportion of future spending that will be conducted online is difficult to predict. However, the pandemic has necessitated an increased switch to online, which may have long lasting impacts. Through our high frequency card spending data we will be continue to monitor and evaluate trends, and the publication of the data and analysis will help policy makers, businesses and consumers to better prepare for the future.

*Email [email protected] and [email protected] if you have any comments or questions on this note. Comments from Rory McElligott, Patrick Haran, Maria Woods, Mark Cassidy and Caroline Mehigan are gratefully acknowledged. The views expressed in this note are those of the authors and do not necessarily reflect the views of the Central Bank of Ireland or the ESCB.

See also: