Central Bank Publishes Macro-Financial Review II 2018

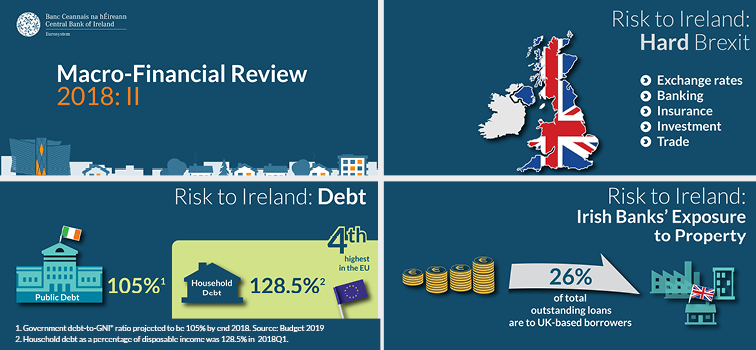

The Central Bank’s second Macro-Financial Review (MFR) of 2018 says that the main risk facing the Irish economy is Brexit, in particular, the possibility of a “no deal” or hard Brexit occurring.

Read the full review: Macro-Financial Review II 2018 | pdf 2089KB

Key Brexit-related risks to the economy highlighted by the Review include:

- A further weakening of sterling that would make Irish exports to the UK more expensive

- An increase in tariffs on Irish exports in the event of a hard Brexit

- Increased competition from UK providers caused by large and persistent currency movements

- Irish retail banks’ exposure to property lending to Ireland and the UK.

Sharon Donnery, Deputy Governor, Central Banking, said: "Whatever form it takes, Brexit will be negative for Ireland. Even in the event of a deal, much uncertainty still surrounds the post-transition environment and this could continue to put pressure on investment that is vital for jobs and economic growth.”

The Review also identified other risks to the Irish economic outlook including:

- A reversal of investor sentiment in financial markets and a correction in asset prices.

- Increased market volatility due to geopolitical developments, including protectionism in international trade and changes in corporate tax arrangements.

- Capacity constraints emerging and the economy operating above potential in the near term.

- Residential real estate price growth bringing valuations close to or above what would be consistent with broader economic developments.

The Macro-Financial Review offers an overview of the current state of the macro-financial environment in Ireland.

Macro-Financial Review 2018 II | pdf 2094 KB

See also: